The NEET Compass [Part Three]

Want To Make Money? The Answer Might Shock You...

If you haven’t read Part One yet, click below:

So far, the NEET Compass has been defined and maximising /comfy/ levels has been explored in great length.

Being /comfy/ is just one part of the equation. The other is having a high-income to live a sustainable high-quality life, with the goal being the upper-right quadrant.

Unlike being /comfy/, earning a high-income is nowhere near as straightforward.

There are multiple avenues that can be taken. Old paths no longer work, and new paths are constantly emerging.

So before we continue, some principles need to be established.

1) Time theft is ethical

In this newsletter, we’re only interested in legal income generation, with a preference for ethical income. Don’t Google ‘avvcbd’ or you’ll get the wrong idea.

However, committing ‘time theft’ at your 9-5 job is completely ethical. You shouldn’t feel bad for only working <10 hours a week yet earning a full-time wage.

The larger the organisation, the more likely they are engaging in illegal or unethical activity behind the scenes or outright exploiting their workers.

Corporations exist to squeeze out every cent of productivity from their employees, even if costs them their physical and mental wellbeing.

Why should you support them and further their growth with your hard work?

Don’t have any sympathy. If you don’t like your company or your job, spend as little time as possible working and sweating for them.

2) Maintain your dignity

Do you really want to act like a Romanian gangster while you tweet about sitting next to Jake Paul’s ex and post low-quality bait like ‘depression isn’t real’?

Do you really want to pretend to run an OnlyFans “empire” when you can’t even photoshop the earnings from your models?

Do you really want to sell an overpriced paid group on ‘financial freedom’ while you’re still earning affiliate income from penis pumps?

Of course you don’t.

In the same way you wouldn’t do YouTube prank videos or dance around like a f4ggot on TikTok for a living, don’t embarrass yourself by pretending to be something you’re not online for money.

There’s no nobility in poverty. There’s none in being a sell-out or a blatant shill either.

3) There is no rulebook

Were you expecting a definitive method on how to make money in this article? No such rulebook exists.

Authors who write books on ‘financial freedom’ and Twitter gurus who went from ‘welfare to millions’ will argue otherwise. Ignore them.

These frauds have an ulterior motive: to push their own narrative to sell overpriced courses, seminars and paid groups. This secures their own income.

Equally as dangerous as ‘get rich quick’ scammers are ‘get rich slow’ boomers.

They will give you outdated advice, like working a part-time job to pay for college and investing in boomer stocks for decades. Boomers pray in the name of the Dow Jones, the S&P500, and Warren Buffett.

Don’t take life advice from a boomer, lest you become one yourself.

What was once a lucrative career path or investment opportunity may have now withered. Sharpen your intellect.

Since there is no rulebook, you will have to create the rules yourself and forge your own path. Take the advice of others with a grain of salt and question the motives of everyone, especially if they’re selling you something.

On the subject of spoonfeeding, this post will not give you step-by-step instructions to earning a higher income, but rather suggest new ideas that you can implement into your own unique situation.

4) A high-income and a truly /comfy/ life are rarely compatible

With a high-income comes added responsibility, pressure, and stress. Maintaining a large investment portfolio, managing unreliable people, coordinating projects, and meeting client expectations will invoke an unavoidable degree of stress.

To make matters worse, achieving a high income in the corporate world by ‘climbing the ladder’ can take up to a decade of education, hard work and commitment to a particular field.

Corporations lure unsuspecting interns and graduates in like a carrot on a stick, promising the naïve that their dreams are just around the corner. Meanwhile the goal post is deliberately pushed further and further back.

Why? Because those above you in the corporate ladder have already played the game. They’re writing the rules to put their own interests first. Company shareholders and executives are being paid handsomely while everyone else is left with scraps— it’s a gig they want to keep going for as long as possible.

Climbing the corporate ladder is a game that is Pay To Win. The price you pay is with your time, your livelihood and ultimately your soul.

Nobody tells you once you’ve started climbing the corporate ladder, there’s no way to come down without falling down and starting again from scratch. Many climb the ladder, realise they’ve made a bad decision, but can’t come down again without undoing the years of labour they’ve sacrificed.

With a system that’s designed to make you fail, how do you beat the odds and climb your way to a high income?

You won’t like the answer. To lessen the pain, let’s introduce NEETOCRACY’s Law.

NEETOCRACY’s Law

Unless you’re going to inherit a significant amount of wealth, it’s unrealistic to think one can earn a high-income without exerting any physical or mental effort.

You can earn a low-income from living off unemployment cheques and sponging off your parents. As inflation continues to climb and the cost of living soars, you should want to do more than barely scrape by.

If you want to earn a high-income, you will have to work for it.

While work goes against the ethos of being a NEET, understand that not all work is created equal. You do not have to flip burgers or scrub toilets earning minimum wage for a living.

Nor do you have to clock in to Mr Shekelstein’s office for five days a week and tabulate Excel data or create Salesforce cases while you roast under fluorescent lights.

The concept of work here is loosely defined. It can mean getting educated and certified in a new field, building a personal brand or running an online business.

All of the options above require effort expended that may not be /comfy/ at all times. You will likely have to work on somebody else’s schedule, usually because of meetings, and be forced to deal with normies.

However, there is light at the end of the tunnel. It may only take a few years of work and some clever investments to fund your NEET lifestyle for up to a decade. Individual results will vary based on your circumstances.

The more planning and work you put in now, coupled with the more risk you’re willing to shoulder, the less you will have to worry about further down the line.

While this approach might seem very familiar to the boomer concept of ‘waging until retirement’, understand that:

We openly admit that climbing the corporate ladder is a scam and aim to work as little as possible

We understand that work is required to accumulate large sums of wealth and that cash injections from a salary are beneficial in covering expenses and making investments

We agree to take a more aggressive approach in investing/entrepreneurship with the goal of working on our own terms, or ideally not working at all

Two strategies for your consideration are presented below.

The first is more /comfy/ at the downside of a lower income.

The second is less /comfy/ but can yield a much greater income.

These are merely suggestions and an accumulation of tried-and-tested tactics from NEETs such as myself.

Strategy #1: Work a /comfy/ Remote Job And Invest In Crypto

WFH (Work From Home) is one of the best unintended side effects of the pandemic.

You can work merely a fraction of the time you would have spent in the office and receive the same pay. Moving forward, WFH should be non-negotiable when you’re applying for a job.

You will save money by WFH, but more important is the time you’ll claim back. I saved three hours of time by not commuting to work each day. Rolling out of bed right before clocking in gives you a lot more time and energy throughout the day.

As an added bonus, you will not have to pretend to fit in with insufferable normies. Less time working, less time commuting and less time dealing with normies: it’s a win-win-win.

Did I mention that vaccine mandates are rarely enforced for remote jobs?

Tip: If your managers are incompetent, which is highly likely, you can keep your work computer unlocked by coding a simple mouse wiggler or presenting a PowerPoint Presentation.

Many normies still haven’t figured this out yet.

With this newfound sense of time, energy and freedom, there are many things you can do. Ideally, you should use this time productively instead of shitposting on forums and playing video games.

From my experience, if you’re looking for a /comfy/ return, dollar-cost averaging into the cryptocurrency markets and actively monitoring your positions is the best use of your residual income and your spare work time.

In 2022, investing in property and shares will not net you life-changing money in the next few years, unless you really luck out. There is still a lot of upside and opportunity in the cryptocurrency markets, which comes at the expense of volatility and uncertainty.

Future articles will be written solely on cryptocurrency if there’s interest. However, I will occasionally post valuable tweets and share alpha in spaces from my experience in the markets.

There is an ever-growing pool of on-chain data you can observe, interpret and analyse. Having access to other people’s trades and positions through the transparency of the blockchain is a blessing.

No investment or return is guaranteed. However, stablecoin yield farming can offer incredible returns, up to 20% in some cases, with very limited risk. There is no reason to earn boomer-like returns from financial instruments like bonds, term deposits or ETFs.

As cringe as NFT culture has become, selecting the right projects to flip can result in 100% profits in the span of a few days. This is a skill which will need to be cultivated, as rugpulls are also frequent.

Dollar-cost averaging into blue-chip cryptocurrencies, like Bitcoin and Ethereum, has proven to generate better returns than mindlessly gambling on low-quality memecoins and altcoins that crash 99% in a bear market and never recover.

As discussed previously, there is no rulebook; you will need to decide your own risk-tolerance and have conviction in your own positions. Your trading skills will sharpen over time and with practice.

Most importantly, research the ecosystem and the technology. Determine for yourself: where you do see Bitcoin and cryptocurrencies heading in the next 3 years?

If you’re investing just $1K a month split into Bitcoin and Ethereum, you are more than likely looking at a six-figure portfolio in only a few years from now as the bull market resumes. All while enjoying a /comfy/ WFH life.

There are downsides, namely adjusting your risk appetite. You will need to feel comfortable with making or losing hundreds or thousands of dollars on any given day, even while you sleep.

However, this is the strategy I’ve used to amass the majority of my wealth and fund my NEET lifestyle.

If you’re not willing to wait for a few years for the cryptocurrency market to climb back up again, here is a more risk-on and less /comfy/ approach.

Strategy #2: Wagemaxx or Skillmaxx

This strategy is the equivalent of going all-in in a game of poker.

Rather than coasting in a /comfy/ WFH job, the strategy here is to aggressively pursue as much income as possible. Let’s refer to this concept as wagemaxxing.

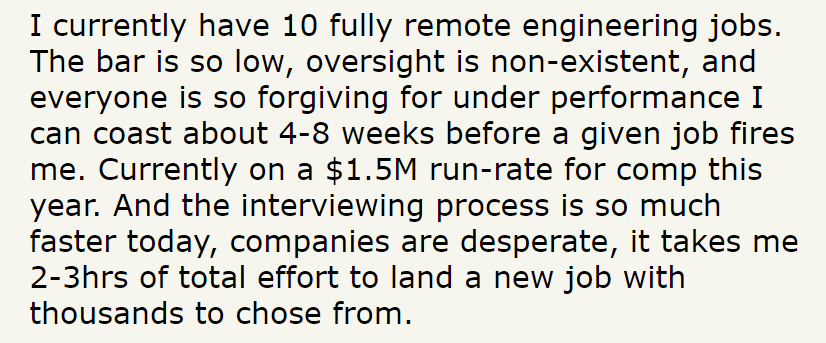

Blogs and communities exist where members discuss working multiple full-time remote jobs, like Overemployed. These members frequently make six-figure incomes and occasionally even seven-figure incomes.

The reality is that many corporate jobs don’t require a full 40 hours a week for all work to be completed. Most meetings are a waste of time and many recurring tasks can be automated or outsourced.

Working two remote jobs effectively doubles your income, shortening the amount of days you will need to wage and lengthening the time you can sustainably spend as a /comfy/ NEET.

Question: Would you rather work harder for a shorter period of time or work not as hard for a longer period of time? The decision is yours.

Refer back to NEETOCRACY’s Law: what this strategy lacks in short-term comfort, it more than compensates for in income.

While Strategy #1 is passive and sensitive to market conditions, wagemaxxing is the more active approach. All responsibility for how many jobs you can juggle and what you earn falls solely on you.

There is also skillmaxxing: working and learning as much as possible to maximise skills to launch your own venture.

This comes as an unintended consequence for the few people who are passionate about their fields. In most cases, it requires formal education and training as well as many hours of hands-on experience in a job.

To illustrate, let’s consider two scenarios:

Scenario 1: Sneed works a /comfy/ corporate job from home which pays well. He wants to get into coding, so he watches a few tutorials and says he will eventually pay for a bootcamp.

Scenario 2: Chuck works an entry-level programming job in the office and is forced to code for multiple hours a day. Anything he doesn’t know, he must learn on the spot or ask more experienced coders.

Who do you think is going to become the more successful coder?

While Scenario 1 is more /comfy/ in the short-term, valuable skills are more than likely not being taught in a WFH setting. There are virtually no opportunities to network or extend beyond one’s comfort zone.

In Scenario 2, skills are being reinforced day-in and day-out. There is more opportunity for one to climb into a better role, to pick the brains of others at the company, and for one to branch out and launch their own venture.

If you wage for something you’re truly passionate about that can also challenge and educate you, you’re decades ahead of your normie competition who wage just to pay the bills.

Many opportunities will come your way if you’re an unrivalled expert in your field. Better yet, you can create your own opportunities.

The best case study I can share is my friend Combat Therapist. He has a wealth of knowledge from being a former semi-pro athlete, his university studies, as well as vast experience from helping clients recover from injuries.

Six month ago, he lost his job because his workplace was mandating Pfizer doom juice. Consider the options he has now:

This is the end-result of being an expert. It cannot be bought. It cannot be faked. It has taken him years of education, training, hard work, and hands-on experience to get him to where he’s at now.

You should consider leveraging any existing talents you have, but it’s never too late to start from scratch. Most importantly, you cannot jump the gun: skillmaxxing is a process that will take time and commitment. It is not for the faint of heart.

In future articles, we will explore what some of the best skills to pursue are and how to build an online business to monetise any skill.

For now, understand that wagemaxxing and skillmaxxing will require considerable hard work, dedication, and focus.

They may not be /comfy/, but balancing multiple full-time jobs or rigorously chasing high-demand skills will lead you to earning a drastically greater income.

Conclusion

Thank you for reading. This concludes the NEET Compass.

My goal is to stimulate thought and discussion around these concepts, so hopefully you learned something new that can improve your situation.

This is not the end, as the NEET Revolution is only beginning.

I am building a brotherhood of like-minded NEETs and aspiring NEETs.

Join the Discord.

Until next time, frens.